As part of the claims process, you would've been receiving your employees' Super Guarantee (SG) and/or PAYG withholding tax amounts from NDIS into your bank account.

You are required to pay these withheld amounts in quarterly instalments (as a minimum) throughout the financial year.

The instalment due dates are:

Quarter 1 (July–September) – payment due 28 October

Quarter 2 (October–December) – payment due 28 January

Quarter 3 (January–March) – payment due 28 April

Quarter 4 (April–June) – payment due 28 July

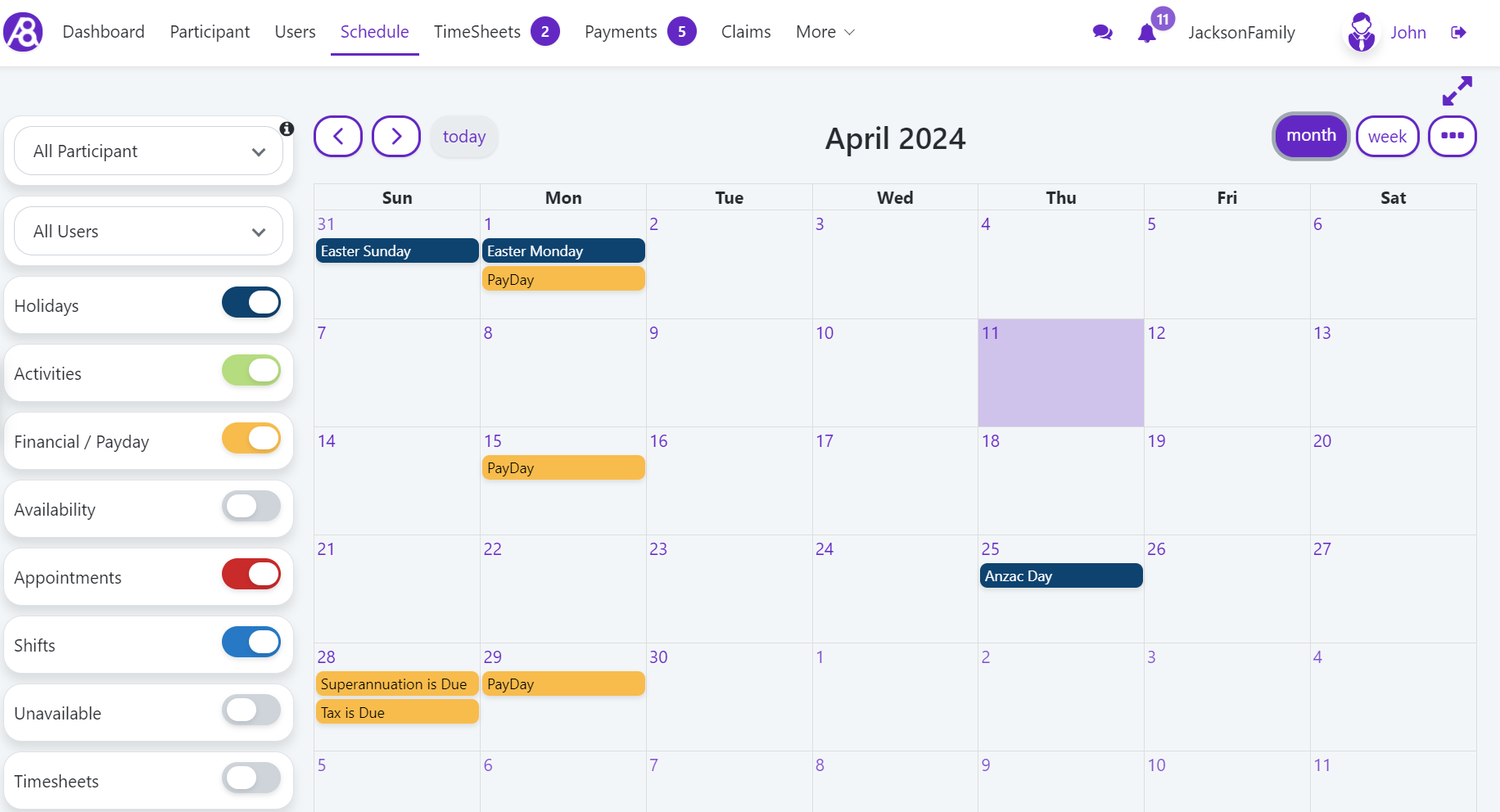

You will notice in the scheduling calendar that there are 'Superannuation is Due' and 'Tax is Due' events displayed on these due dates. One week before the due date, you will receive reminders via email notifications.

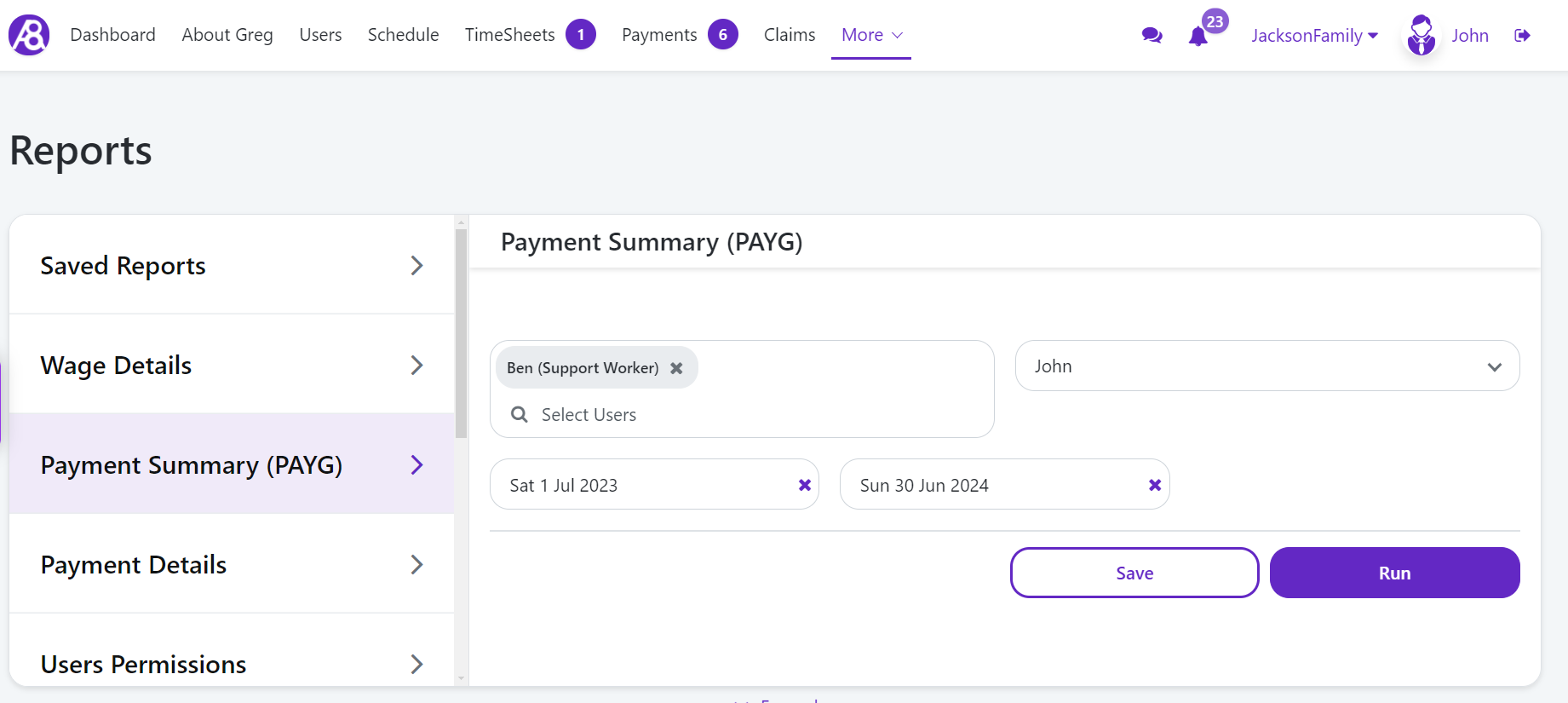

Go to the More menu > Reports.

Enter the start date and end date for the quarterly period.

Click Run.

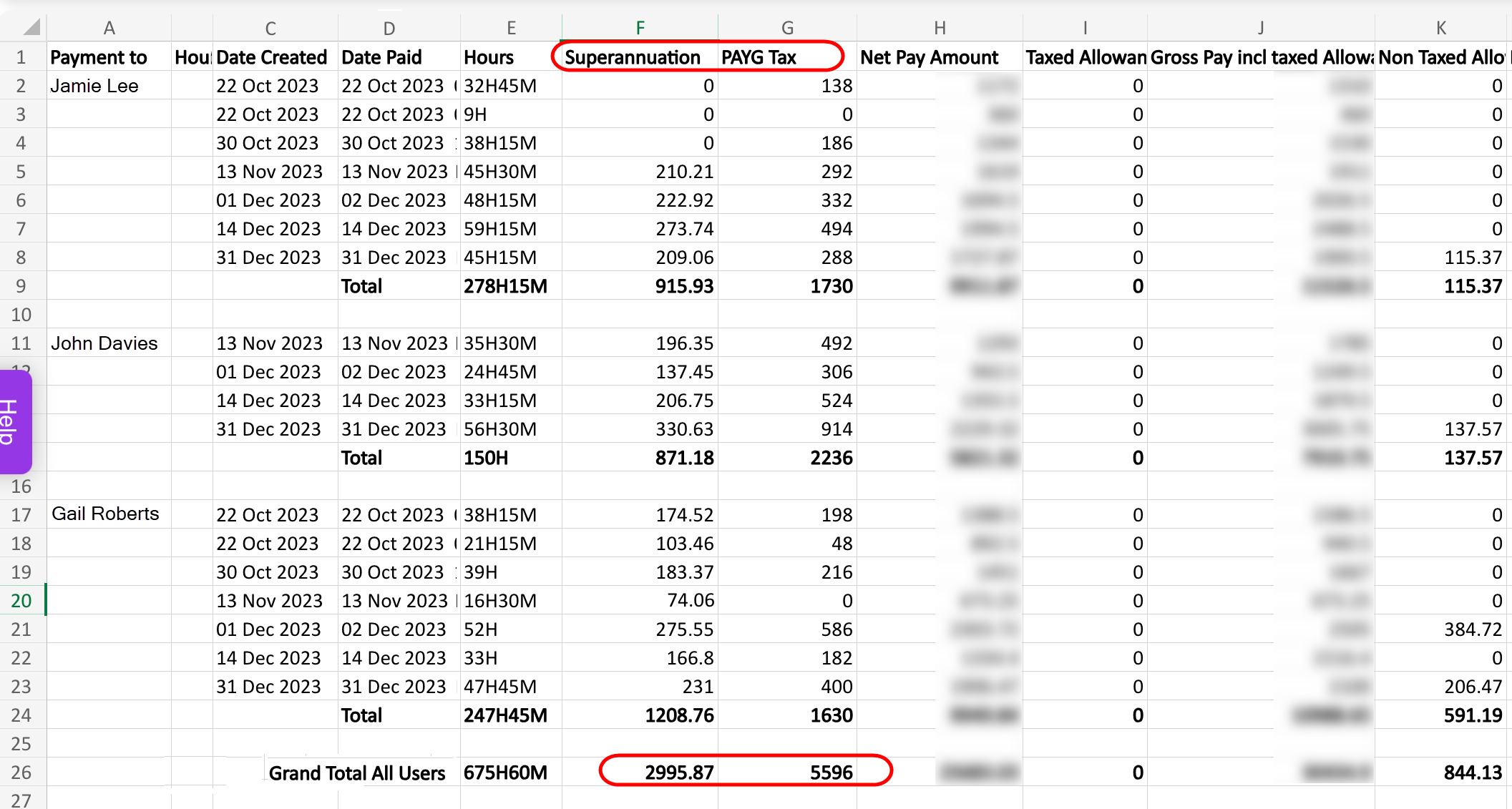

Download or print the Wage Details report for easy reference when making Super and Tax payments.

PAYG withholding activity statements and tax payments are made through your myGov account that is linked to the ATO.

Once you've completed the PAYG activity statement and made the payment to the ATO, you should email the receipt (or transaction record) to the Ability8 app to create a payment record.

In Payments, open the payment record and run the OCR/populate the following fields:

Description - enter a payment description, e.g. PAYG Payment Q2 2023/24

Participant - if multiple PWDs, select the PWD or participant.

Type - select 'Service'.

Payment To - select the ATO PAYG contact, or click +Add to create a new contact for ATO PAYG.

Invoice or Receipt No. - enter the PRN or reference number.

Start Date/End Date - enter the start and end dates of the quarterly period.

Allocation - select 'No allocation to a funding source'. This has already been claimed when wages were processed.

Unit Value - enter the total value of tax collected (for all employees) as shown in the Wages Detail report.

Click Approve.

From the Payments list view, click Pay to set the status to 'Paid'.

Super payments can be made to the super funds via a Superannuation Clearing House such as the - ATO Small Business Superannuation Clearing House (SBSCH) which is also accessed through your myGov account.

Alternatively, you can pay through other commercial Clearing Houses or directly into each employee's super fund.

Once you've made the payment to the Super Clearing House, you can email the receipt (or transaction record) to the Ability8 app to create a payment record.

In Payments, open the payment record and run the OCR/populate the following fields:

Description - enter a payment description, e.g. Super Payment Q2 2023/24

Participant - if multiple PWDs, select the PWD or participant.

Type - select 'Service'.

Payment To - select the Super Fund or Clearing House, or click +Add to create a new contact for the super fund.

Invoice or Receipt No. - enter the payment/transaction receipt number.

Start Date/End Date - enter the start and end dates of the quarterly period.

Allocation - select 'No allocation to a funding source'. This has already been claimed when wages were processed.

Unit Value - enter the total value of super contributions (for all employees) as shown in the Wages report.

Click Approve.

From the Payments list view, click Pay to set the status to 'Paid'.

If your employees were eligible to incur PAYG withholding tax on their wages, you must give each of them a payment summary by 14 July each year, even if the withheld amount is nil. This includes employees that have been terminated during the financial year.

Ability8 provides a Payment Summary (PAYG) report that you can download or print out for each staff member.

PAYG payment activity statement for the final financial year quarter needs to be paid to the ATO by the 14 August. The payment activity statements must include the total amount of all payments made and all amounts withheld for all workers, this includes employees that have left your employment or have been terminated during the financial year.

To obtain the required information, you can run the Wage Details report for the financial year date range. You can download or print the report to use as a reference when inputting data into ATO PAYG portal.

Further information can be found on the Ability8 Help article : https://help.ability8.app/en/articles/95-annual-payg-withholding-reporting-no-stp and ATO website: https://www.ato.gov.au/Business/PAYG-withholding/Annual-reporting/