If your employees were eligible to incur PAYG withholding tax on their wages and you are not using STP feature, you must give each employee a "Payment Summary" by 14 July each year, even if the withheld amount is nil. This includes employees that have left your employment or been terminated during the financial year.

Ability8 provides a "Payment Summary (PAYG)" report that you can download or print out for each staff member. - see instructions below

You also need to provide the ATO with a final quarter PAYG payment activity statement and this is populated via MyGov and on to your linked ATO website account.

Once connected to your ATO website account, go to the "Home" icon and find the "For Action" list where you will find any current activity statements that are due and need to be populated. These are usually populated on a quarterly basis, so you should see an "April to June" activity statement ready to be populated.

The PAYG payment activity statement must include the total amount of payments made and all amounts withheld for all workers for the April to June quarter.

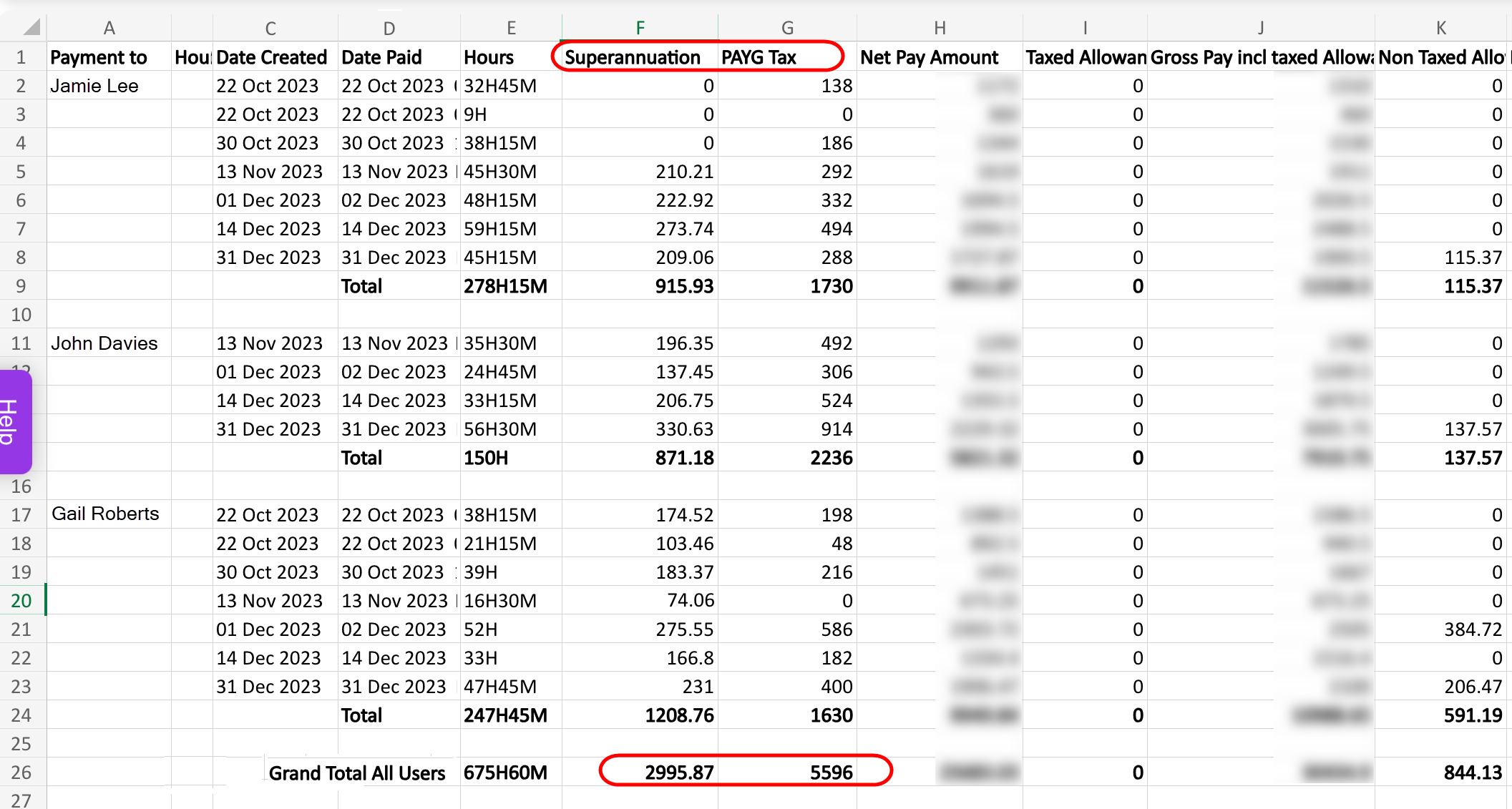

To obtain the required information to populate the PAYG payment activity statement, you can run the Wage Details report for the final quarter or the full financial year - See instructions below.

Keep this to populate the ATO activity statement.

Go to the More menu > Reports.

Select Wages Details Report

Select the individual employee or leave blank for all employees

Enter the start date (1 July) and end date (30 June) for the annual period or the 1 April to 30 June quarter as needed.

Click Run.

Download or print the Wage Details report for easy reference when making Super and Tax end of year reporting.

Consider attaching a copy of the downloaded document to your own user profile in the documents section for good record keeping.

Provide this to all employees before 14 July each year.

Go to the More menu > Reports.

Select Payment Summary (PAYG) Report

Select the individual employee or leave blank for all employees. NOTE: If you need individual PDFs for each employee you should run a report for each employee separately.

Select the authorised person from the drop list

Enter the start date (1 July) and end date (30 June) for the annual period, these should be pre populated.

Click Run.

Check the contents of the report for each employee and then download or print the Payment Summary (PAYG) report for easy reference and distrubution to the employees by 14 July each year.

Consider attaching a copy of the downloaded PDF document to each user profile in the documents section for good record keeping.