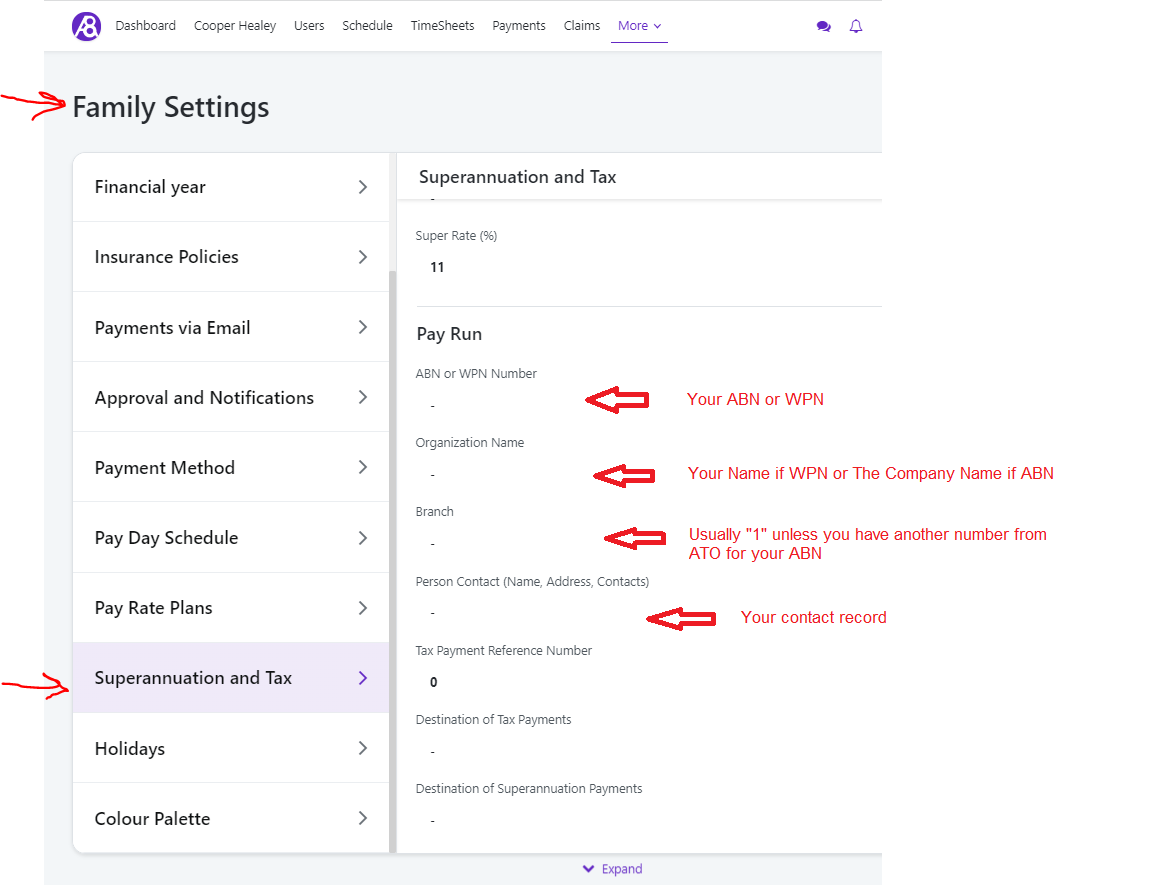

Check that the tax and super details are correct for you (as the payer) in Family Settings, and the staff members (as the payees) under their individual User Profiles.

Ability8 connects to the ATO automatically using Sending Service Provider (SSP). This means you do not need to contact the ATO to connect Ability8.

Steps for sending pay report via STP:

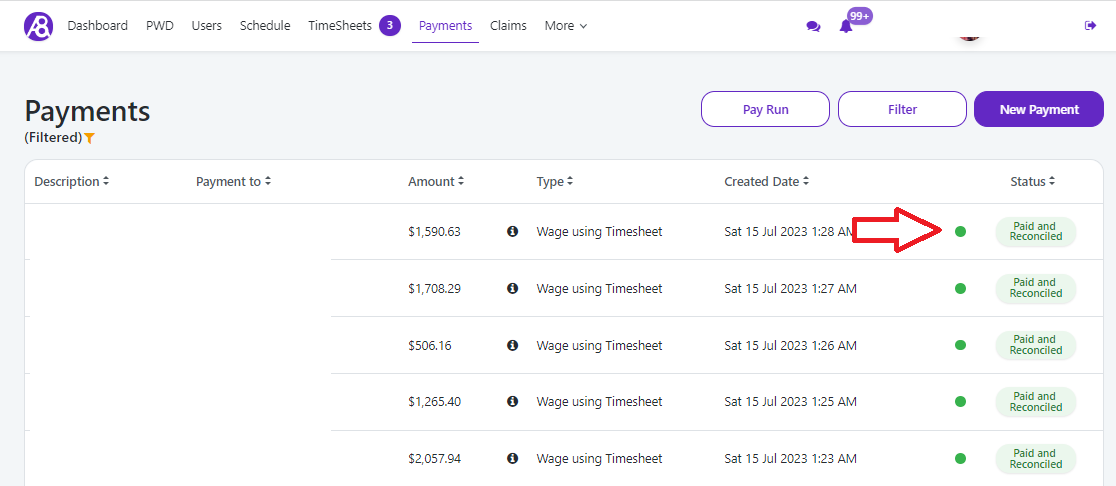

Complete your normal payroll process up to the point where the payment status is 'Paid'.

At the top of the Payments list view, select the Pay Run button.

Any errors will be displayed under the STP main screen. Errors need to be resolved before you can submit the STP transaction to the ATO.

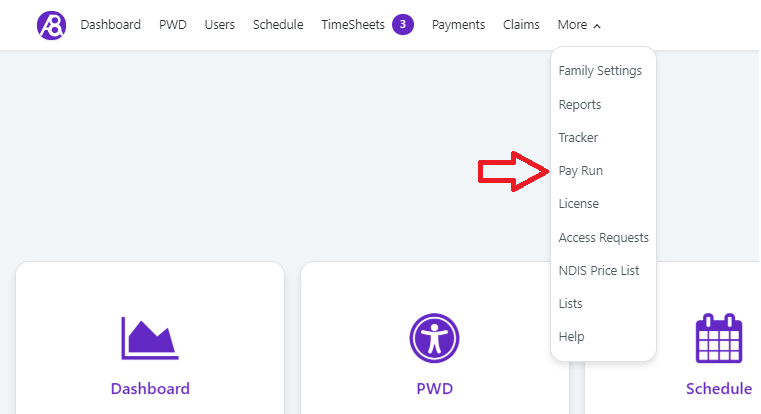

Once you submit the transaction, you can either wait until you receive a status update, or you can continue using the app and return to the STP transactions via the:

More menu > Pay Run, or

Payment list view

The status will change to a blue dot to indicate it is 'Queued' while the transaction is being processed by the ATO. Once complete, the status will change to green to indicate 'Success'.

If an error appears, you will need to fix the issues listed at the bottom of the screen and resubmit the request. If you need any assistance, please reach out to our team via the chat widget.